Unemployment tax calculator 2023

Modified Adjusted Gross Income for the ACA premium subsidy is basically your adjusted gross income AGI plus tax-exempt muni bond interest plus untaxed Social Security benefits. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate.

. Updates to the Arizona State Tax Calculator. With low unemployment rates and a huge variety. Updates to the Colorado State Tax Calculator.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. Detailed data on nonfatal injuries and illnesses including by occupation event source and nature can be found in worker case and demographic data.

Start filing your tax return now. Terms and conditions may vary and are subject to change without notice. Save money on taxes and see how Income Tax and National Insurance affect your income.

Offer period March 1 25 2018 at participating offices only. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

Taxable social security income. Use our UK salary calculator to find out how much you really earn. See the latest industry incidence rates OSHA recordable case rates or calculate a firms incidence rate by using BLSs incidence rate calculator.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. The Sales Tax. To qualify tax return must be paid for and filed during this period.

The minimum wage listed applies to employers with 21 or more employees. Offer period March 1 25 2018 at participating offices only. Terms and conditions may vary and are subject to change without notice.

More information on calculating incidence rates. Tax calculations allow for Tax-Deferred Retirement Plan. Tax calculations allow for Tax-Deferred Retirement Plan.

People without kids. For a list of state unemployment tax agencies. 2022 Marginal Tax Rates Calculator.

Use Schedule H to figure your total household employment taxes social security Medicare FUTA and withheld federal income. Return filed in 2023 2021 return filed in 2022 Income. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

The following updates have been applied to the Tax calculator. Quickly Estimate 2022 Personal Income Taxes 2023 Income Tax Refunds. 2022 Simple Federal Tax Calculator.

Annual indexing beginning 7-1-2022. 1040 Tax Estimation Calculator for 2022 Taxes. Section 179 deduction dollar limits.

For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children. The minimum wage will not increase when Chicagos unemployment rate is greater than 85 for the preceding year. Terms and conditions may vary and are subject to change without notice.

W-2 Forms from all of your employers that you worked for in the past year. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. In 2022 the EITC is 560 to 6935.

Deferred compensation contribution limit increased. UK Tax Rates for 2022 2023. Enter the amount you earned before taxes were deducted for the.

May not be combined with other offers. Scotland Tax Band Tax Rate Taxable Income. Tax Return Access.

Employers with 20 or fewer employees have a minimum wage of 1450. Shared-cost tax based on costs from the previous year for benefit payments that cant be attributed to specific employers. Enter your filing status income deductions and credits and we will estimate your total taxes.

Unemployment compensation and alimony. In 20112012 it temporarily dropped to 1330 565 paid by the employee and 765 paid by the employer. May not be combined with other offers.

The combined tax rate of these two federal programs is 1530 765 paid by the employee and 765 paid by the employer. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. The estimated benefits amount is an estimate only and does not guarantee that you will receive unemployment insurance benefits.

Updates to the Georgia State Tax Calculator. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. State law instructs ESD to adjust the flat social tax rate based on the employers rate class.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Tax calculations allow for Tax-Deferred Retirement Plan. You only have to answer the survey once to unlock the tax calculator for 24 hours.

Benefits Calculator When will you file for Unemployment Benefits. Tax Return Access. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and 090 for 2025.

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. Glad for so many who were paid unemployment in 2020 that 10200 of unemployment is tax exempt but it appears to create. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. The following updates have been applied to the Tax calculator. To qualify tax return must be paid for and filed during this period.

UK Income Tax excl. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries. The Social Security tax rates from 19372010 can be accessed on the Social Security Administrations website.

Enter your filing status income deductions and credits and we will estimate your total taxes. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. If youre married and filing a joint return.

The following updates have been applied to the Tax calculator. You must meet all requirements before you are eligible to receive benefits. Calculating 2022 Marginal Tax Brackets for IRS Payments Due April 17 2023.

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. Person 1 Husband Earned Income. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

The cliff is scheduled to return in 2023. 900 to 924 effective 7-1-2022.

Simple Tax Refund Calculator Or Determine If You Ll Owe

What Is The Bonus Tax Rate For 2022 Hourly Inc

2022 Income Tax Brackets And The New Ideal Income

Doing Business In The United States Federal Tax Issues Pwc

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Missouri Income Tax Rate And Brackets H R Block

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Calculators And Forms Current And Previous Tax Years

2022 Income Tax Brackets And The New Ideal Income

Liechtenstein Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical

Llc Tax Calculator Definitive Small Business Tax Estimator

New Jersey Nj Tax Rate H R Block

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

2022 Federal State Payroll Tax Rates For Employers

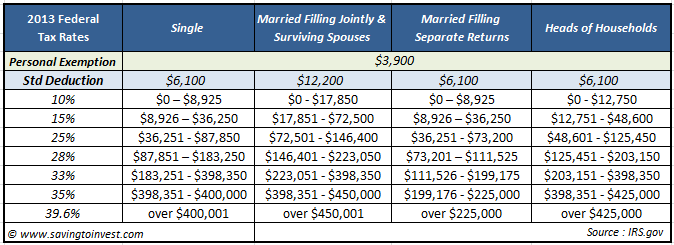

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest